ERC Program: Get up to $10,000-$26,000 FREE in GRANT per Employee For Your Business...

(Open for a Limited Time)

Don't worry, BLC will help you make sense of it all. Click the 'Connect with our Experts Now"

Did you watch the Video? If you didn't, We suggest you do. Almost all the basic information you need to know about the ERC Program is in there.

Your business may be eligible for a refundable tax credit called the ERC. (check the FAQ section at the bottom below)

The ERC Program is designed to help businesses (with 5-500 W2 Employees) that were able to retain their employees during the Covid-19 pandemic.

It’s a refund of past salaries and health care costs paid to your employees during 2020 and 2021. Your business can get up to $26,000 per employee.

You won't find out if your company is eligible if you do not apply.

We want you to imagine for a second how much impact a legal FREE MONEY (Refundable Tax Credit) in form of GRANT from the government could do for your business right now?

Think about it for a minute!

If you did think about it, then you can imagine the potential benefits the ERC Program opportunity stands to bring to your business.

We believe that you are on this page right now because we may have reached out to you in one way or the other via Ads, Email, google Or Direct message.

We partner with Bottom Line Concepts to bring you the ERC Program.

If you go through Lifeimpactful.com, you will find that one of the few things we set out to do is that we intend to share opportunities/products/services/information that we believe will add value to life (people and businesses).

We in return sometimes get rewarded in form of commissions from the businesses we partner with at no extra cost to you once you use our buttons and links to connect.

You are not required to pay any upfront fee until you receive your money

Also, Trust us, your CPA might want to sit this one out as it's a bit more complex.

All that our partners require of you is your information for filling and patience.

You will get weekly updates on their progress.

We ask that you use our links/buttons to connect with our experts as it means a lot to us and helps us grow. Thank You!

We have more things to explain to you...keeping reading...

ERC Program is Time-Bound & Risk Free

The ERC program is a limited opportunity that wouldn't be around for long and its the more reason you need to click the 'connect bottom' right now to begin the process.

We will be going straight to the point on why you shouldn't waste any more time before you get into this ERC program, a once in a lifetime opportunity for your business.

In our opinion, ERC is a once in a lifetime opportunity.

It doesn't discriminate.

The fundamental thing is to meet the required criteria and your business is good to go.

Our main goal here is to connect you with our ERC experts at BLC, who has been able to claim over $2billion worth of funds for businesses under the ERC program for 30,000 US businesses and counting.

We have done the research for you all you need to do is reach out to them via our link and you get your process going.

A quick google search review on Bottom Line Concepts showed that people love them for their services and are happy to share their experience with the world. They got a 4.9 approval rating on google. It's mind boggling! (We shared more google reviews below this page)

Okay, the next review below is not related to ERC, but here is what David Brandon, former Board Chairman for Domino's Pizza, Inc. has to say about our partners at Bottom Line Concepts. (Check below for more testimonials from businesses)

More on ERC...

One of the fundamental IRS requirement in the ERC program that our BLC partners work with is that your business must reside in the United States of America with W2 Employees, at least up to a minimum of 5 to 500 employees, and you were established before February 15th 2021.

Having the W2 employees on your payroll means you pay taxes to the US government.

I know that you have a lot of questions in your mind, I will try to explain as much as I can before connecting you with our expert partners who will give you further clarification and also take care of all the paperwork and processing.

You might be having double thoughts about the whole program, and that's why I am personally explaining a few things before handing you over to our ERC specialists who deal directly with IRS to see the whole process through for you.

What is ERC program, and How Can Your Business Benefit from it?

ERC (Employee Retention Claim) is a stimulus program designed to help those businesses that were able to retain their employees during the Covid-19 pandemic.

Established by the CARES Act, it is a refundable tax credit – a grant, not a loan – that you can claim for your business.

The ERC is available to both small and mid-sized businesses.

It's a great way to help your business recover from the effects of the pandemic.

So don't wait! Connect with our partners today and let them help you file for the ERC Program. You won't regret it!

Click to see if your business is eligible for the ERC Program.

ERC is NOT like PPP fund (Note that even if you received the PPP (Paycheck Protection Program) fund, you can apply for the ERC program).

ERC fund is NOT a LOAN.

It's a GRANT from the government approved by the US legislature, which the IRS is seeing through for small businesses.

The ERC program is just like the Government saying THANK YOU to 'you' for having faith, staying strong and keeping your business afloat during the pandemic.

The Government knows how important keeping your business afloat each year means to them, and this is why they decided to reward small businesses that have 5 to 500 W2 employee.

This opportunity is only open to businesses for a limited time before the IRS closes the doors.

It is the more reason why you need to take action. (Check the FAQ section below for more)

Two Ways To Qualify

Two Specific Ways to Qualify for ERC

1. Decline in gross revenue. Each quarter is independently measured against the comparable quarter in 2019

50% decline in 2020 (Q2,3,4)

20% decline in 2021 (Q1,2,3)

2. Full or partial suspension of operations

The second way to qualify is if your business experienced a full or partial suspension of operations. A partial suspension is defined by having to make modifications to the operations of a business due to government orders resulting in a “nominal effect” to the business operations.

“Nominal Effect” – IRS Notice 2021-20 – Page 39 “The mere fact that an employer must make a modification to business operations due to a governmental order does not result in a partial suspension unless the modification has more than a nominal effect on the employer’s business operations. Whether a modification required by a governmental order has more than a nominal effect on the business operations is based on the facts and circumstances. A governmental order that results in a reduction in an employer’s ability to provide goods or services in the normal course of the employer’s business of not less than 10 percent will be deemed to have more than a nominal effect on the employer’s business operations.”

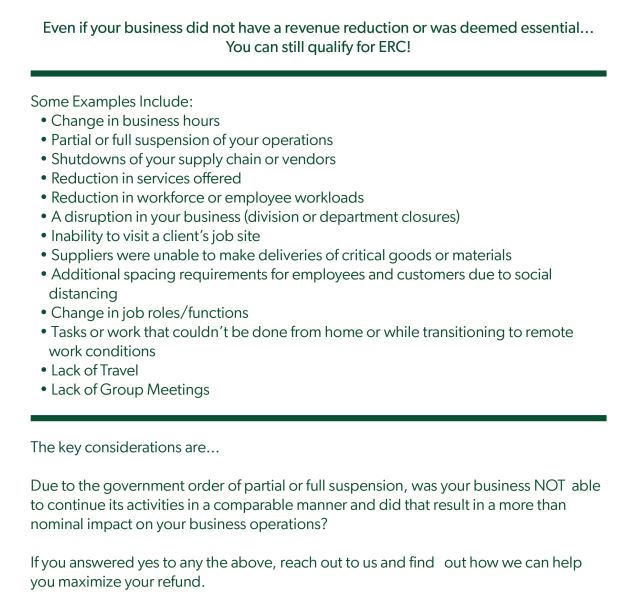

The considerations for determining the nominal effect are that you would be able to say yes to at least one of the bulleted items in the list of Covid Operational Qaulifiers. These are examples of disruptions, or modifications you may have made to the operation as a result of government orders.

This ERC program is for you if...

- You are a small business established in the United States of America

- Your business was established prior to 15th of February 2020

- You have 5 - 500 W2 number of Employees on your tax payroll

- You pay your US payroll Tax

- Your business is not funded by the Government

For Further Clarification & to start your filing process, connect with our ERC Expert Specialists right now. Click the bottom to connect.

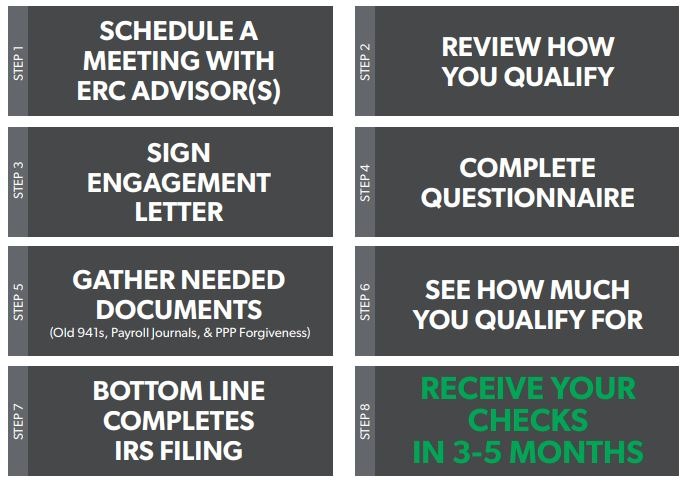

How the Process Works - Timeline

Don't hesitate to apply. The sooner you apply, the sooner you can receive your credit.

Why You Should Work With Our Partners At BLC (Bottom Line Concepts)

BottomLine Concept (BLC) launched its Government Aid Division to help small businesses impacted by Covid-19.

BLC Specialize in Maximizing the Employee Retention Credit (ERC) Program.

Click the button to start (take action Now)

What Clients Have To Say About Bottom Line Concept

Bottom Line Concepts Client Base Around The World

Enter your text here...

Don't Wait Until Tomorrow ! Begin the process right Now!

Click the Connect green Button

Get access to our ERC Specialized Experts now!

Our ERC Experts at BLC will take care of all the paper work and processing from A-Z.

All that is required from you is to provide the required details which will enable them to determine if your business qualify and how much you are eligible to.

Any further questions you may have will be answered by our BLC ERC specialists.

Once you provide the required details, someone will reach out to you.

Try it Out 100% Risk-Free (You Only Pay Our Team After You have Received Your Fund From IRS)

Our service is only payable when you claim the retention credit from IRS ."

You will not be required to pay our team at BLC a single cent. Our service is only payable when you receive the credit from the IRS and we will assist you throughout the process to ensure fast & successful claim.

.

FAQ

Here are answers to some frequently asked questions on ERC Program:

What is ERC program all about?

When does ERC program end?

Do we still qualify if we did not incur a 20% decline in gross receipts?

Taxes & Commissions

What period does the program cover?

How to Qualify for ERC Program?

Do we still qualify if we already took the PPP?

How do I qualify?

Do we still qualify if we remained open during the pandemic?

Get access to our ERC Specialists now!

Your business may be eligible for a refundable tax credit...find out Now not later...

Our Experts will help you check and File for your ERC claims...

Just Fill the ERC form and leave the main work to our Team to deal with.

If you would Love to reach us anytime, please kindly click here. We will be happy to hear from you. Thanks

Don't forget to use our link (Buttons) to connect to our Partners...By doing so, you will be supporting us at no cost to you.

(Email us to sign you up if you are not a business and you have local US businesses to refer to our partners)

© 2023 Lifeimpactful. All rights Reserved | Disclaimer|Affiliate Disclaimer